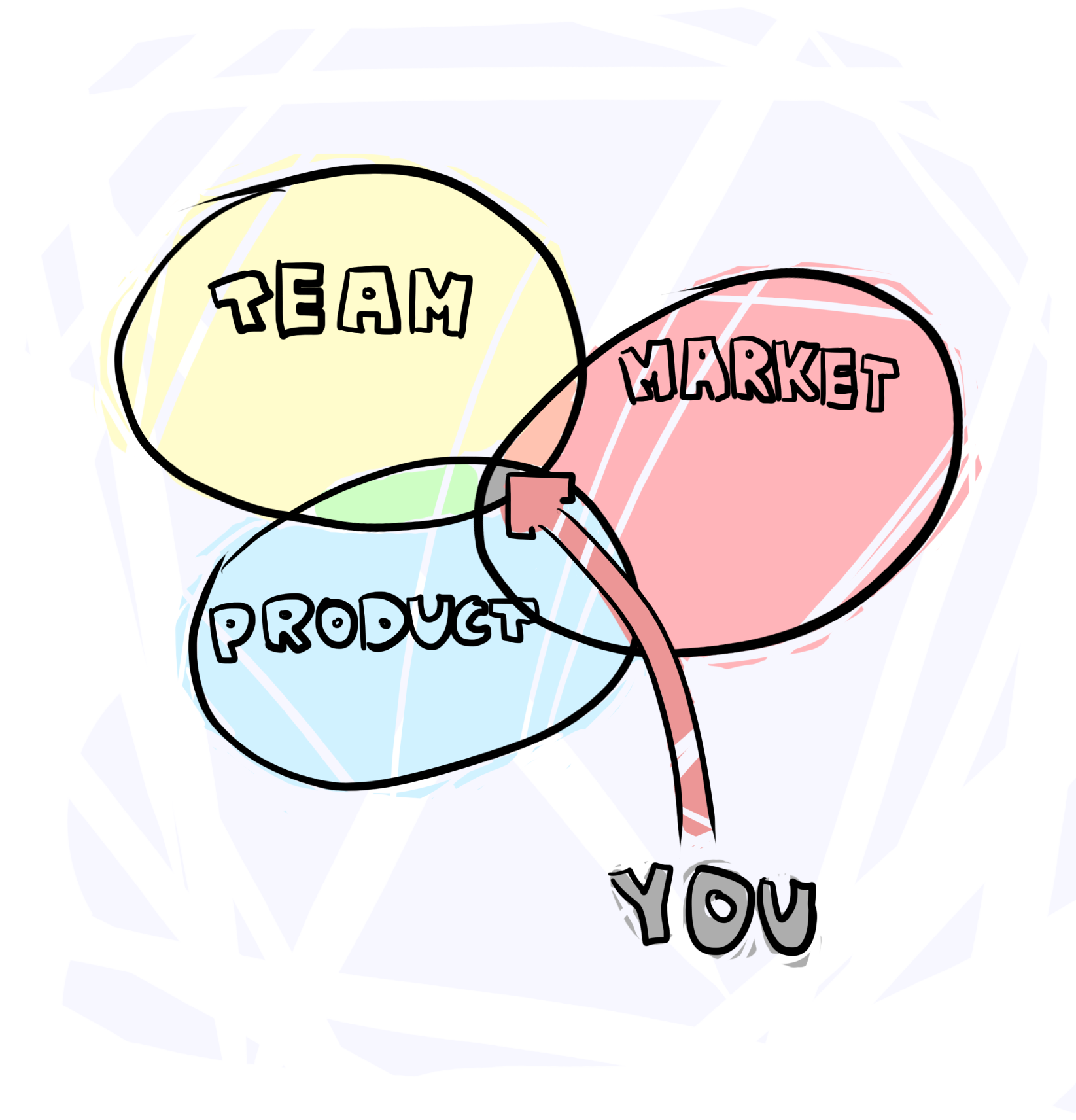

Sophisticated investors evaluate three central areas of a potential investment: the team, the market, and the product(s). Different investors weight the three sides of the triad differently, but all three are vital to building a scalable, thriving startup.

The team is almost universally considered the most important of the three factors. The reason for this is that the business model will change, probably significantly, as the company experiments and grows. The people behind the business will have to evaluate the data, and make the decisions that will make or break the company. Execution is 99% of a company’s success.

The market has to be “big enough” and growing quickly. A market that’s large and growing makes it possible to build a significant company with a high valuation. This all translates into strong returns for the investor. A market that’s “big enough” is usually at least $500 million.

Finally, investors consider the product. They want to understand its value proposition, the pain it solves, and its long-term defensibility. Traction with customers is usually the best way to demonstrate your product’s worthiness from an investor’s perspective.

Get investors motivated by completing the triad.