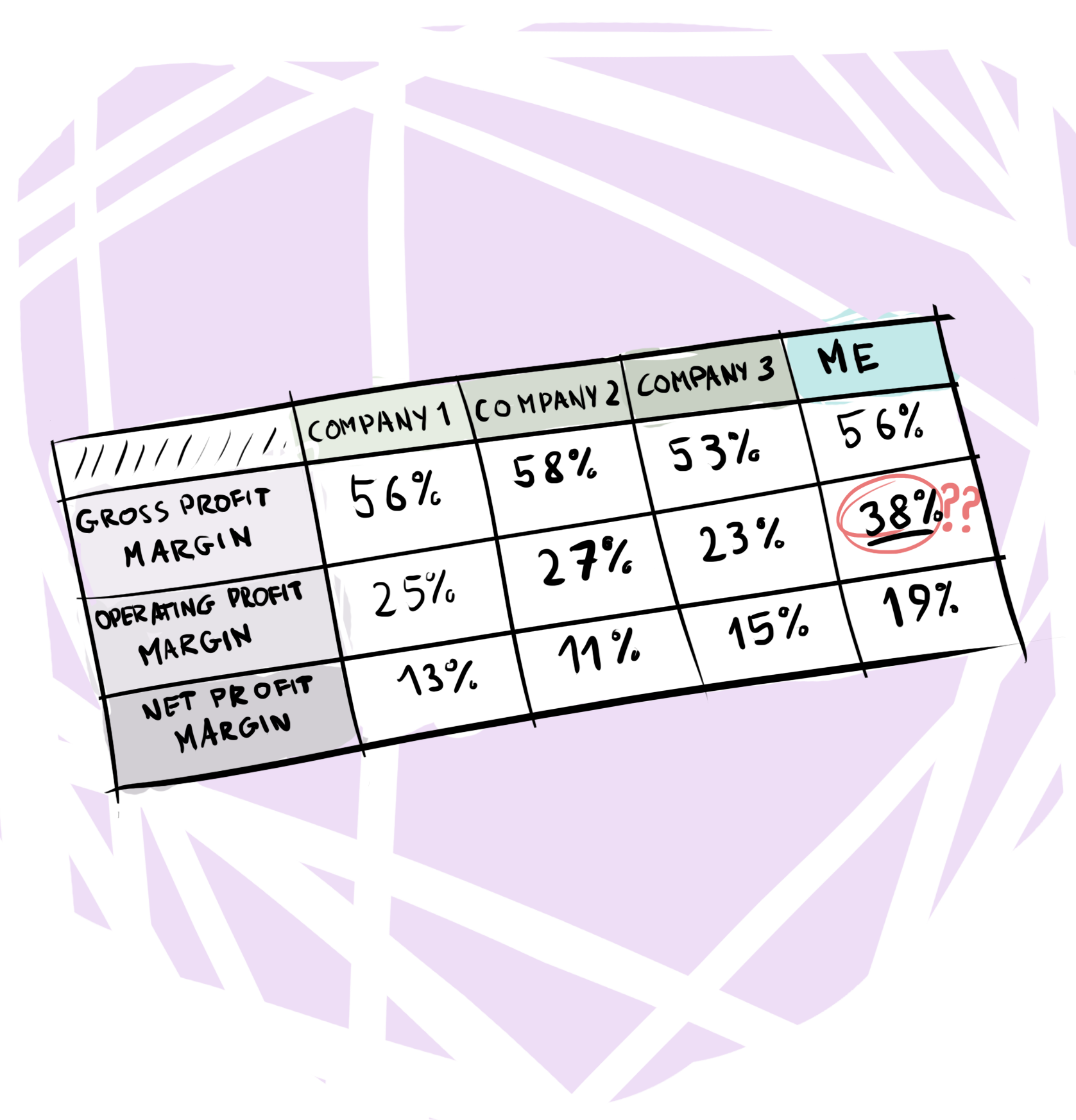

Your financial projections are based on hundreds of assumptions and unknowns, so you have to sanity check your results. There are a couple great ways to do this. By far, the most important sanity check you can do is to compare your financial ratios with your industry’s standards. By combining the financial performances of companies in an industry, you can get an understanding of the industry norms. One great resource for this is the Risk Management Association, which provides industry ratio reports. Compare these results to year five of your projections. Are there any significant variations? If so, be sure that you understand which assumptions directly affect the variance and check their validity. If there are any discrepancies, the safest approach is to revert to the industry’s ratios.

Next, go through every assumption in your financial model with your advisors. There might be an important oversight or error in your calculations, or you might have misjudged a key assumption. Industry or startup veterans should be able to uncover weaknesses quickly. Either way, getting a second pair of eyes on your work will help fine-tune your model.

If you’re going after investors, your financial projections will get the most scrutiny. If your ratios are off, or assumptions are aggressive, you better have rock-solid explanations at the ready.